You may be wondering, what is Bitcoin, how does it work and are there any risks involved?

Ebonex has you sorted – here’s everything you need to know.

What is Bitcoin?

Bitcoin, a form of cryptocurrency or digital/ virtual currency, was launched in 2009 by Satoshi Nakamoto, a presumed pseudonym. Bitcoin uses peer-to-peer technology to operate without reliance on central authorities or banks.

The network collectively manages and issues Bitcoin. This network uses a decentralised ledger system known as a blockchain.

Bitcoin is open-source, with a publicly available design. Essentially, nobody owns or controls the Bitcoin entity as anyone across the globe can access it.

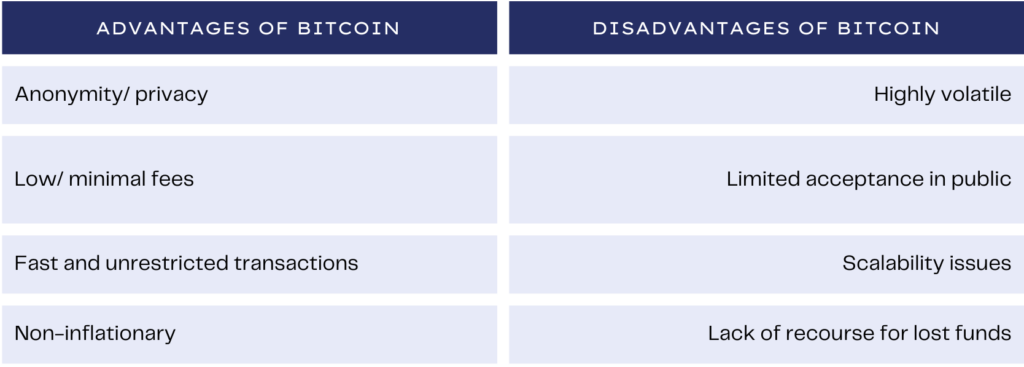

Advantages

Bitcoin has many advantages over the traditional banking system as a form of currency.

Although all transactions are viewable on the network, the process is anonymous and private. The only details listed are the transaction amounts and Bitcoin wallet addresses – which display as a random string of letters and numbers.

This process provides freedom where Bitcoin can be transferred to any person, anywhere in the world, at any time, with no intermediaries or restrictions on amounts.

Bitcoin transactions are very fast when compared to traditional banking services. The blockchain network processes and verifies most transactions within 10 minutes.

There are also much lower associated fees when compared to costly international transfers through banks or other payment services.

One of the main advantages of Bitcoin (and all other cryptocurrencies) is that they are unaffected by inflation in the economy. Fiat currencies will lose value over time as the Government prints money to cover national debts.

In comparison, Bitcoin has a fixed supply cap of 21 million coins – meaning no more than 21 million coins will ever be in circulation.

Disadvantages

On the other side, Bitcoin has a few disadvantages over the traditional banking system and fiat currency.

One disadvantage of Bitcoin is its volatility. Even though the currency has received coverage in the media and a surge in popularity over the last few years, it is still an emerging market. Compared to major fiat currencies, the market is much, much smaller.

Investment in Bitcoin is risky and thrives on speculation. Holding large amounts on Bitcoin can also influence the trade quite suddenly.

The main disadvantage of this currency is the lack of resources if you lose access to your Bitcoin wallet or accidentally send funds to the wrong address. While a backup phrase can be used to recover your wallet, little can be done if it is misplaced.

Due to Bitcoin’s decentralised nature, there is no way to recover lost funds.

The legal status of these tokens varies from country to country, with many unsure how to navigate the waters. Although most countries don’t currently accept Bitcoin as a form of payment, there are different regulatory implications in specific markets.

The number of businesses and individuals that currently accept Bitcoin as a form of payment is still small, although it is rapidly growing.

While regulated in many countries around the world, countries such as Algeria, Bolivia, China, Colombia, Egypt, Indonesia, Iran, Iraq, Nepal, North Macedonia, Russia, Turkey, and Vietnam have banned cryptocurrencies as a form of payment for goods and services.

Some countries have placed limitations on cryptocurrency, others have heavy penalties for anyone making crypto transactions.