A cryptocurrency exchange is a platform that allows investors to trade, buy and sell a variety of cryptocurrencies. Every exchange has its own rules and regulations.

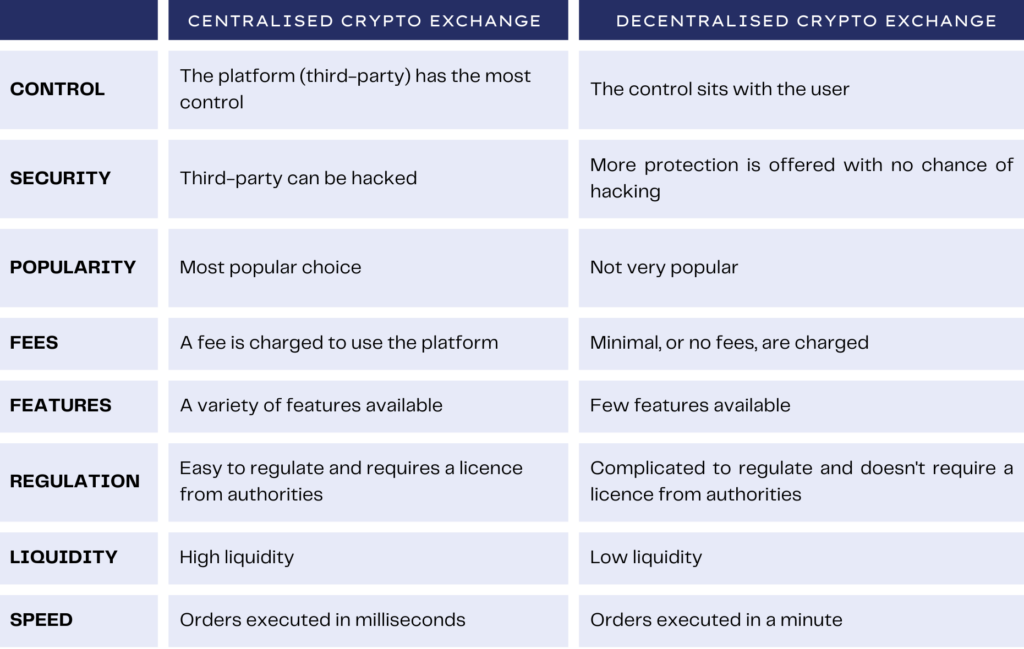

There are two kinds of crypto exchanges in the market, that both hold a range of advantages and disadvantages. These are known as centralised exchanges and decentralised exchanges.

Centralised Exchanges

A centralised cryptocurrency exchange is a platform where you can buy or sell digital assets like Bitcoin. The exchange monitors the transactions and secures assets for the buyer and seller, which is managed internally on their servers and requires users to trust a third party.

These deals aren’t tracked on the blockchain. Most centralised exchanges are also required to verify your identity for safety purposes. The more details provided, the higher your withdrawal quota.

Most centralised exchanges provide users with flat pairs at stable prices and rank quite popular among crypto users as they are easily accessible platforms found online.

Some examples of centralised exchanges include Ebonex, Coinbase, Binance and Kraken.

Decentralised Exchanges

A decentralised cryptocurrency exchange (also known as DEX) on the other hand, does not rely on a third party, and all of the funds remain stored on the blockchain.

These platforms rely on peer-to-peer (P2P) systems for trading, and users maintain full control of their cryptocurrency. Transactions are operated using smart contracts, which are open and transparent for anyone to audit.

Some examples of decentralised exchanges include Uniswap, SushiSwap, TokenIon and Venus.

Pros and Cons of Centralised and Decentralised Exchanges

There are pros and cons to both centralised and decentralised exchanges. The majority of traders find centralised exchanges most suitable for them due to them being user-friendly and having easy access to liquidity.

Decentralised exchanges benefit from much lower fees, and higher security, as there’s no risk of the exchange being hacked.

Moving into the future, both types of exchanges will coexist.

Centralised exchanges will probably still dominate most of the trading volume, however, leaps in technology will keep pushing DEXs forward, and will probably see hybrid models emerge, e.g. centralised exchanges using smart contracts.

Selecting whether you want to buy, sell or trade on a centralised exchange or decentralised exchange is a case of personal preference that is dependent on your goals and level of engagement.

As stated, if you go with a decentralised exchange, there is a far higher level of involvement and responsibility in keeping your assets in order.