Peer to peer trading (P2P) is the act of buying or selling cryptocurrency directly between users without the need for a third-party (i.e. exchange or broker). On traditional exchanges, transactions are organised on your behalf, so you are not actually transacting directly with the counterparty that you are buying or selling to.

P2P trading gives you more control over who you buy and sell to, the price, and settlement time, but there are also risks involved without the use of a third-party broker.

Although there is no intermediary, P2P trading is still generally done via an exchange or marketplace that connects crypto buyers and sellers. Similar to a platform like eBay, people can post listings (buy/sell orders), and the platform also provides a level of protection and trust between the users.

This can be done through features such as a public rating system, which reviews the trust of each user. Some platforms will also offer an escrow system, which is where the platform will hold the crypto until both parties have confirmed the transactions, and then credit each user.

Some popular P2P crypto trading platforms include Paxful, Localbitcoins, BinanceP2P, Bisq and LocalCoinSwap.

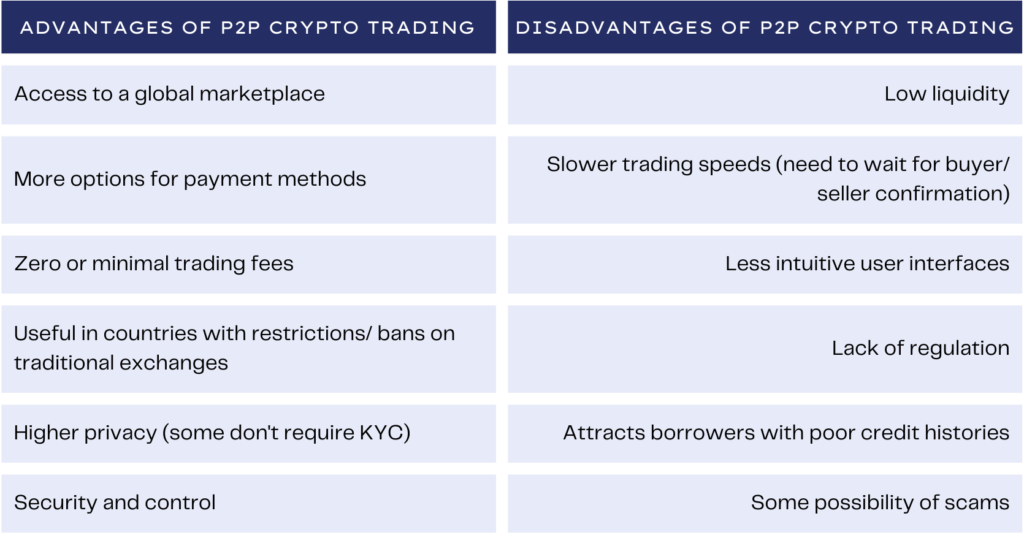

Advantages of Peer to Peer Trading

Access to a global marketplace: A P2P exchange will give you access to a global market of buyers and sellers, where crypto can be bought and sold within seconds.

More options for payment methods: There are often limitations with payment options on traditional exchanges. A P2P exchange removes this limitation as there are often many more options available.

Reduced trading fees: P2P exchanges will often offer reduced or minimised trading fees. As there’s no central server, each peer is responsible for storing and sending information, meaning no fees are charged by the application host.

Higher levels of privacy: While most P2P platforms will ask for sign-up, very little will ask for personal information such as identification/ passports/ etc.

Security and control: Users have complete control over currencies and protection over their identity as there’s no third-party involved. P2P has no single point of failure, so if a node goes offline or suddenly becomes unavailable, the network can still function.

Disadvantages of Peer to Peer Trading

Low liquidity: Peer to peer trading is still relatively new and has lower liquidity than centralised exchanges.

Slower trading speeds: Unlike traditional trading, where there’s no wait time with transactions for the buyer/ seller, P2P exchanges incur slower trading speeds. While the transaction is near-instant once both parties confirm the transaction, there may be delays from one party – slowing down the whole trade.

Lack of regulation: While the lack of rules that dictates trade activity is seen as one of the main benefits of P2P trading, it can also pose some challenges. Peers are responsible for managing their own transactions and are accountable for completing trades with the potential risk of unreliable buyers and sellers.

Attract borrowers with poor credit histories: The network’s freedoms attract those who no longer qualify for traditional loans and trade.

Possibility of scams: Accessing file sharing applications can raise security concerns, such as scams and malware.

A peer-to-peer exchange is known for the decentralised network, transparency and highly secure transaction mechanism.

While there are many advantages and disadvantages, peer-to-peer trade can be used to a buyer’s advantage.