Cryptocurrency has been praised for its potential for financial inclusion and a simplified financial services infrastructure around the world.

With the rapid rise in the circulation of cryptocurrencies over the past few years, central banks are stepping up their efforts to explore their own stable digital currencies.

Read on to find out more about central bank digital currencies and their potential role in our future.

What is a Central Bank Digital Currency?

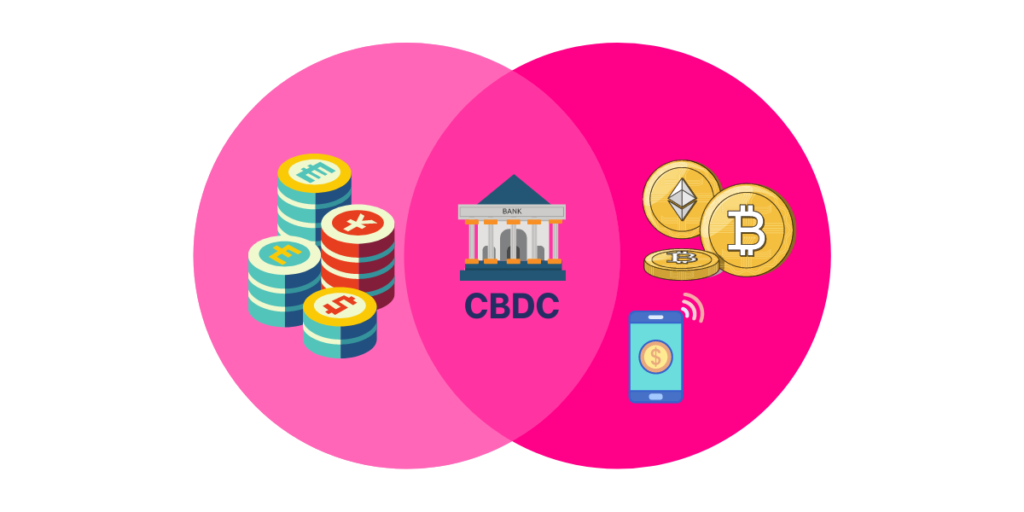

The term Central Bank Digital Currency, commonly known as CBDC, refers to the virtual form, electronic record or digital token of a country’s official fiat currency.

Where fiat money comes in the form of banknotes and coins and is a legal tender that can be used for the sale and purchase of goods and services, a CBDC is just a digital form of that. Just like fiat money, CBDC has the complete backing of the issuing government.

As CBDCs represent fiat currency, the main goal is to provide users with the expected convenience and security of the digital sphere, as well as the regulated and reserve-backed circulation of the traditional banking system.

Governments are experimenting with CBDC with blockchain at its core.

The idea behind a CBDC is that it can be a form of currency and new payment technology, to increase payment efficiency and costs, and be interoperable with a blockchain.

Common CBDC Features

CBDCs are intended to promote financial inclusion and simplify the implementation of monetary and fiscal policy.

While it’s still very early in the life cycle of CBDCs, it’s unclear how most will operate and feature to benefit the end-user.

The key essential difference is the digital nature of the currency, and its proposition to act as a hybrid of Bitcoin and a Government-issued currency. It could be imagined that the benefits would be increased security and protection against scammers and fraudulent attacks on private accounts.

Types of CBDC

There are actually two main types of CBDCs – wholesale and retail.

Wholesale CBDC

Wholesale CBDC is just like traditional central bank reserves. This type utilises the existing tier of banking and financial institutions to conduct and settle transactions. Wholesale CBDC can help to improve the efficiency of payments and security settlement.

Value-oriented wholesale CBDCs can ensure the replacement or support for recipients in the central bank through a restricted-access digital token. Senders can transfer value to the receiver during the transaction without any intermediaries, differing from the existing system.

Wholesale CBDCs are considered to be favourable for central banks and provide good capabilities for improving the speed and security of wholesale financial systems while reducing costs.

Retail CBDC

Retail CBDC focuses on the general public. Generally, retail CBDCs are based on distributed ledger technology, including the features of availability, anonymity and traceability. Retail CBDC is popular due to the motivation for capitalising on opportunities for growth in fintech markets.

The promotion of financial inclusion presents a faster shift to a cashless society and helps to reduce the cost of cash printing and management.

Advantages and Disadvantages of CBDC

Like anything, there are a series of advantages and disadvantages that will be faced with the introduction of CBDCs.

Advantages

As the process between banks and wholesale CBDCs is automated, there will now be a direct connection between consumers and central banks through retail CBDCs. These digital currencies can help to minimise the effort and process of functions such as the calculation and collection of taxes.

CBDCs will assist in eliminating barriers large parts of the unbanked population face. One of the main barriers developing and poor countries face is the cost associated with developing a banking infrastructure. Moving this online, CBDCs establish a direct connection between consumers and central banks.

Disadvantages

A central authority will still be responsible for and invested with the authority to conduct transactions, so CBDCs won’t necessarily solve the problem of centralisation.

Unlike cryptocurrencies, users would still be required to give up some degree of privacy, as the administrator will need to collect and disseminate digital identifiers. This leads way to issues of privacy and hackers.

Legal and regulatory issues are still up in the air. As a system that engages in cross-border transfers, it begs the question of whether CBDCs should also be regulated across borders.

CBDC in Practice

Countries have started to express interest in creating their own CBDC, however only a few so far have been able to execute these plans to date. Most notably, China has released their Digital Yuan. South Korea has completed demo releases and is in the pilot stage of technology.

Many other countries are still in the formulation stage. The key fact is, that it’s only a matter of time until Government-backed digital currencies are the norm.

Each country has its own approach. Venezuela was a pioneer with respect to CBDC. In 2018, Venezuelan president, Nicolas Maduro, introduced a crypto token called Petro – a digital currency that was claimed to be backed by Venezuela’s rich oil reserves.

Unfortunately, the token was far from successful, as it was plagued with problems and very few Venezuelans used it.

Given the potential for political and global embarrassment, many countries are now taking their time making the move over.

The US Government has also teamed up with the prestigious Massachusetts Institute of Technology (MIT) to experiment with a digital dollar.

Why So Many Countries Are Exploring CBDCs

Bitcoin has grown and expanded to global success since its release in 2009, exceeding all expectations. It wasn’t until 2019 when Facebook released Libra, a centralised corporate-backed digital currency, that the narrative started to change.

Facebook was feared to potentially challenge the government, with its access to personal information and its widespread digital currency. It was restricted swiftly, governments began to explore whether they could incorporate these technologies into their national payment systems.

The eventual global adoption of CBDCs, alongside blockchain and digital protocols, is only a matter of time.